Foreigners to pay more for Australian housing

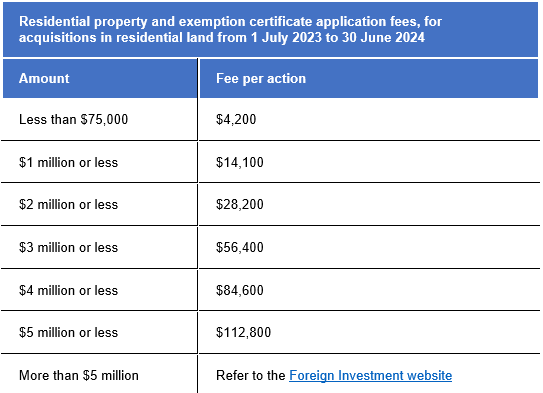

Currently, foreigners must pay the following fees when applying to acquire Australian residential property:

(Source – Australian Taxation Office)

The bill proposes that the fee for an application to acquire existing residential property will be tripled.

Foreign nationals are generally banned from acquiring existing property, but can do so in limited circumstances such as when they have a temporary visa to work in Australia.

In addition, the Bill proposes to double the amount of vacancy fees. The vacancy fee is currently the same amount as the acquisition fee on the property.

Foreign owners of Australian residential property acquired after 9 May 2017 are required to file an annual vacancy fee return, even if the property was residentially occupied or genuinely made available for rent during the year. This requirement may also apply where a foreign person acquired the residential property prior to 9 May 2017 but failed to submit a foreign investment application.

A vacancy fee is payable by a foreign owner if the residential property is not:

- Residentially occupied (meaning under a lease/license for a minimum of 30 days)

- Genuinely available on the rental market; or

- Rented out for at least 6 months in a year on a long term basis.

A vacancy fee may also apply if the vacancy fee return is not lodged by the required due date,

As an example, a foreign investor who acquires a new apartment for $1.5 Million will pay $28,200 on application.

If that investor leaves the property vacant, then they will pay a vacancy fee of $56,400 per year. This fee may also be payable where the vacancy return is not lodged by the due date.

The new fees will occur from the later of 1 April 2024 or when the Bill receives Royal Assent.

For further information please contact your usual Mazars advisor or alternatively one of our tax experts via the form below or on:

Brisbane – Jamie Towers | Melbourne – Evan Beissel | Sydney – Gaibrielle Cleary |

+61 7 3218 3900 | +61 3 9252 0800 | + 61 2 9922 1166 |

Sources:

New foreign investment laws to boost housing supply | Treasury Ministers

Fees for foreign residential investors | Australian Taxation Office (ato.gov.au)

Published: 14/02/2024

Author: Jamie Towers

All rights reserved. This publication in whole or in part may not be reproduced, distributed or used in any manner whatsoever without the express prior and written consent of Mazars, except for the use of brief quotations in the press, in social media or in another communication tool, as long as Mazars and the source of the publication are duly mentioned. In all cases, Mazars’ intellectual property rights are protected and the Mazars Group shall not be liable for any use of this publication by third parties, either with or without Mazars’ prior authorisation. Also please note that this publication is intended to provide a general summary and should not be relied upon as a substitute for personal advice. Content is accurate as at the date published.