Mazars 2023-24 Federal Budget tax & superannuation brief

The Budget forecasts the underlying cash balance to be in surplus by $4.2 billion in 2022–23, the first surplus since 2007–08, followed by a forecast deficit of $13.9 billion in 2023–24.

Putting forward a “responsible budget” for uncertain economic times, the Treasurer has described the tax measures as “modest, but meaningful”, including changes to the Petroleum Resources Rent Tax and confirmation of a 1 January 2024 implementation of the BEPS Pillar Two global minimum tax rules.

A range of measures provide cost-of-living relief to individuals such as increased and expanded JobSeeker payments and better access to affordable housing. No changes were announced to the Stage 3 personal income tax cuts legislated to commence in 2023–24.

As part of the measures introduced for small business, a temporary $20,000 threshold for the small business instant asset write-off will apply for one year, following the end of the temporary full expensing rules.

The Treasurer has continued to keep the Labor party’s 2022 Federal election campaign promise and kept the ‘stage 3’ tax cuts legislated to begin on 1 July 2024.

With little in the way of meaningful tax reform, this Mazars Federal Budget Brief summarises the key tax and superannuation announcements that we expect will most affect Mazars individual and business clients.

Please note that as these are just announcements they cannot be regarded as law until legislated.

The full Budget papers are available at www.budget.gov.au and the Treasury ministers’ media releases are available at ministers.treasury.gov.au. The tax, superannuation and social security highlights are set out below.

Read ahead:

> GST and other indirect taxes

Businesses

Small business depreciation — instant asset write-off threshold of $20,000 for 2023–24

The instant asset write-off threshold for small businesses applying the simplified depreciation rules will be $20,000 for the 2023–24 income year.

Small businesses (aggregated turnover less than $10 million) may choose to calculate capital allowances on depreciating assets under a simplified regime in Subdiv 328-D of ITAA 1997. Under the simplified depreciation rules, an immediate write-off applies for low-cost depreciating assets.

The measure will an immediate write-off for eligible assets costing less than $20,000 first used or installed between 1 July 2023 and 30 June 2024. The $20,000 threshold will apply on a per asset basis, so small businesses can instantly write-off multiple low-cost assets.

Assets costing $20,000 or more will continue to be placed into a small business depreciation pool under the existing rules.

Without this announcement, following the ending of the Temporary Full Expensing rules on 30 June 2023, the Instant Asset write-off for small business would otherwise fall back to $1,000.

Increased deductions for small and medium business expenditure on electrification and energy efficiency

An additional 20% deduction will be available for small and medium business (aggregated turnover up to $50M) expenditure supporting electrification and energy efficiency.

Eligible expenditure may include the cost of eligible depreciating assets, as well as upgrades to existing assets, that support electrification and more efficient use of energy. Certain exclusions will apply, including for electric vehicles, renewable electricity generation assets, capital works and assets not connected to the electricity grid that use fossil fuels.

Examples of expenditure the measure will apply to include:

- assets that upgrade to more efficient electrical goods (eg energy-efficient fridges)

- assets that support electrification (eg heat pumps and electric heating or cooling systems), and

- demand management assets (eg batteries or thermal energy storage).

Total eligible expenditure for the measure will be capped at $100,000, with a maximum additional deduction available of $20,000 per business. When enacted, the measure will apply to eligible assets or upgrades first used or installed ready for use between 1 July 2023 and 30 June 2024. Full details of eligibility criteria will be finalised in consultation with stakeholders.

Note: All other assets acquired from 1 July 2023 will be subject to normal depreciation rules which is a significant departure from the extremely generous write-off rules from the past few years.

FBT exemption for eligible plug-in hybrid electric cars to end

The FBT exemption for eligible plug-in hybrid electric cars will end from 1 April 2025. Arrangements involving plug-in hybrid electric cars entered into between 1 July 2022 and 31 March 2025 will remain eligible for the exemption.

Accelerated deductions and reduced MIT withholding tax for new build-to-rent projects

An increased capital works deduction rate and reduced withholding on managed investment trust (MIT) payments will apply to eligible new build-to-rent projects where construction commences after 7:30 pm (AEST) on 9 May 2023.

The capital works deduction rate will increase from 2.5% to 4% per year for eligible new build-to-rent projects. Taxpayers can claim a deduction for capital expenditure incurred in constructing capital works, such as income-producing buildings, under Div 43 of ITAA 1997. Currently, the capital works deduction rate of 4% per year only applies in relation to income-producing buildings used mainly for industrial activities and certain buildings providing short-term traveller accommodation.

The final withholding tax rate on fund payments from eligible MIT investments will be reduced to 15% for income from new residential build-to-rent projects. Fund payments to non-residents attributable to MIT residential housing income are currently subject to a final withholding tax rate of 30%. The reduced rate will apply to income attributable to eligible residential build-to-rent projects from 1 July 2024.

The measure will apply to build-to-rent projects consisting of 50 or more apartments or dwellings made available for rent to the general public. The dwellings must be retained under single ownership for at least 10 years before being able to be sold and landlords will be required to offer a lease term of at least 3 years for each dwelling. Consultation will be undertaken on implementation details, including any minimum proportion of dwellings being offered as affordable tenancies and the length of time dwellings must be retained under single ownership.

Clean building MIT withholding tax concession to be extended

The clean building managed investment trust (MIT) withholding tax concession will be extended from 1 July 2025 to eligible data centres and warehouses, where construction commences after 7:30 pm (AEST) on 9 May 2023.

A final withholding tax rate of 10% applies to fund payments from eligible clean building MITs that are made to non-residents in information exchange countries. An eligible clean building MIT refers to a withholding MIT that holds one or more clean buildings. A clean building MIT cannot derive assessable income from any taxable Australian property other than its clean buildings and assets “reasonable incidental to” those clean buildings.

Eligibility for the concession will be extended to data centres and warehouses that meet the relevant energy efficiency standard, where construction commences after 7:30 pm (AEST) on 9 May 2023. The measure will also raise the minimum energy efficiency requirements for existing and new clean buildings to a 6-star (currently 5-star) rating from the Green Building Council Australia or a 6-star (currently 5.5-star) rating under the National Australian Built Environment Rating System. Consultation will be undertaken on transitional arrangements for existing buildings. The measure will apply from 1 July 2025 when enacted.

Franked distributions funded by capital raisings — start date postponed

The start date of a measure to prevent franked distributions funded by certain capital raisings announced in the 2016–17 Mid-Year Economic and Fiscal Outlook (MYEFO) has been postponed to 15 September 2022 (originally to apply from 19 December 2016).

Certain distributions funded by capital raisings made on or after 15 September 2022 will be prevented from being frankable. The measure ensures such arrangements cannot be put in place to release franking credits that would otherwise remain unused where they do not significantly change the financial position of the entity. A Bill to introduce this measure is currently before the Senate.

Patent box measures not to proceed

The patent box regime announced in the Coalition government's 2021–22 Budget, and expanded in the 2022–23 Budget, will not proceed. The patent box regime proposed to tax certain corporate income at an effective tax rate of 17%. The patent box measures were to apply to medical and biotechnology, agricultural and low emission innovation.

Industry Growth Program

Some $400 million will be spent over 4 years to establish an Industry Growth Program supporting Australian small and medium-sized businesses (SMEs) and startups. This support will be directed towards businesses operating in the priority areas of the National Reconstruction Fund (NRF).

The NRF is a fund designed to invest, by way of loans, equity or guarantees, in:

- renewables and low emissions technologies

- medical science

- transport

- value-add in agriculture, forestry and fisheries, and resources

- defence and enabling capabilities.

Over $50 million has been allocated to the establishment and operation of the National Reconstruction Fund Corporation (NRFC), with an additional $8 million over 4 years to oversee the NRFC.

Delay of biodiversity stewardship certificates

The commencement of the issue of biodiversity stewardship certificates under the Agriculture Biodiversity Stewardship Market scheme, the sale of which would be treated as primary production income, will be delayed from 1 July 2022 to 1 July 2024. This measure was announced in the Coalition government's 2022–23 Budget. The delayed introduction aligns the commencement with the Nature Repair Market (NRP), which is part of the government's Nature Positive Plan. The NRP will receive $7.7 million in 2023–24 for the development of a foundation, including detailed rules, or methods, for different types of projects.

Increased Location Offset incentive to boost film industry

The Location Offset rebate for films will be increased to 30% of Qualifying Australian Production Expenditure (QAPE) from the current 16.5% rate. The increase is intended to attract investment from large-budget screen productions and provide domestic employment and training opportunities. The minimum QAPE thresholds will be increased to $20 million for feature films (currently $15 million) and $1.5 million per hour for television series (currently $1 million). Funding for these measures have been allocated for 4 years beginning from 2024–25.

Funding of $0.5 million has also been allocated over 3 years from 2024–25 (and $0.2 million per year ongoing) for the Australia-India Audio-Visual Co-Production Agreement to enable eligible producers to access the Producer Offset (a refundable tax offset for approved Australian expenditure).

Not-For-Profit

Deductible gift recipients list to be updated

The list of specifically listed deductible gift recipients (DGRs) will be updated to list the following organisations as DGRs for the following dates:

- The Voice No Case Committee from the day after the entity is registered with the Australian Charities and Not-for-profits Commission to 30 June 2024

- Justice Reform Initiative Limited from 1 July 2023 to 30 June 2028

- Susan McKinnon Charitable Foundation Ltd from 1 July 2023 to 30 June 2028, and

- Transparency International Australia from 1 July 2023.

The following organisations’ DGR endorsement will also be extended for the following dates:

- Victorian Pride Centre Ltd from 9 March 2023 to 8 March 2028, and

- Australian Sports Foundation Charitable Fund from 1 July 2023.

The start date for the previously announced listing of 28 entities related to community foundations affiliated with the peak body Community Foundations Australia will be deferred from 1 July 2022 to the date of assent of relevant amendments to the tax law. The 30 June 2027 end date for the listing is removed. DGR status for these foundations will be subject to ongoing endorsement by the Commissioner under new ministerial guidelines.

The listings of Lord Mayor’s Charitable Foundation and Foundation Broken Hill Limited will be made consistent with that for other community foundations, including removal of end dates where applicable.

Multinationals

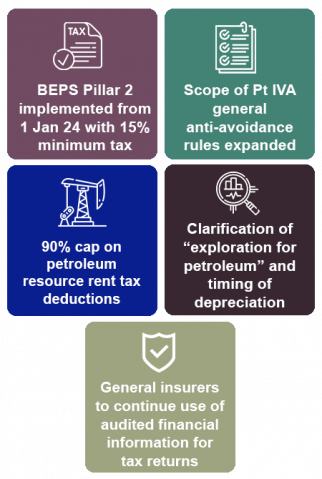

Australia will implement BEPS Pillar 2 from 1 January 2024

Australia will implement key aspects of the Pillar Two solution to address tax challenges from digitalisation of the economy for Action 1 of OECD/G20 Base Erosion and Profit Shifting (BEPS) Project.

- A 15% global minimum tax will apply to large multinational enterprises, with the Income Inclusion Rule (IIR) applying to income years starting on or after 1 January 2024 and the Undertaxed Profits Rule (UTPR) applying to income years starting on or after 1 January 2025.

- A 15% domestic minimum tax will apply to income years starting on or after 1 January 2024.

Both the global and domestic minimum tax will be based on the OECD's Global Anti-Base Erosion Model Rules (or GloBe rules). These rules impose a top-up tax on a resident multinational parent or subsidiary company if the group's income is taxed below 15% overseas.

The IIR would allow Australia to apply a top-up tax on a resident multinational company, where the group’s income in another jurisdiction is being taxed below the global minimum rate of 15%. The UTPR would allow Australia to apply a top-up tax on a resident subsidiary member of a multinational group if the group’s income in another jurisdiction is being taxed below the global minimum rate of 15% and where no IIR applies.

The domestic minimum tax gives Australia first claim on top-up tax for any low-taxed domestic income. If a large multinational company's effective Australian tax rate is below 15%, the domestic minimum tax enables Australia to collect the revenue that would otherwise be collected via another country's global minimum tax.

The rules apply to multinational enterprises with an annual global revenue of EUR750 million (approximately $1.2 billion) or more.

Scope of Pt IVA general anti-avoidance rules expanded

The scope of the general anti-avoidance rules in Pt IVA of ITAA 1936 will be expanded to capture schemes that result in reduced Australian tax via lower withholding tax rates on income paid to foreign residents.

The reach of this regime will also extend to schemes with a dominant purpose to reduce foreign income tax, if it provides an Australian income tax benefit. The changes will apply to income years starting on or after 1 July 2024, regardless of whether the scheme was entered into before 1 July 2024.

Pt IVA generally applies to schemes entered into with the sole or dominant purpose of obtaining a tax benefit. A “scheme” means any agreement, arrangement, understanding, promise or undertaking — whether express or implied and whether legally enforceable or not — and any scheme, plan, proposal, course of action or course of conduct (s 177A of ITAA 1936). If Pt IVA applies to a scheme, the ATO may cancel the tax benefit, make compensating adjustments and impose substantial penalties.

Changes to Petroleum Resource Rent Tax (PRRT)

Significant changes to the PRRT will be implemented following recommendations from a Treasury Review of Gas Transfer Pricing Arrangements Final Report.

The changes include capping certain deductible expenditure at 90%. This is intended to bring forward PRRT revenues with an estimated impact of $2.4 Billion over 5 years from 2022-23.

“Exploration for petroleum” meaning clarified; timing of depreciation

Legislative amendments will be made confirming that mining, quarrying and prospecting rights can only be depreciated for income tax purposes from the time they are used not from the time they are held.

Legislative amendments will be made to the reflect the decision of the Full Federal Court in FC of T v Shell Energy Holdings Australia Ltd 2022 ATC, the Commissioner's application for special leave to appeal to the High Court having been refused.

Amendments will be made to clarify that mining, quarrying and prospecting rights can only be depreciated for income tax purposes from the time they are used. Merely, holding such assets does not trigger depreciation deductions. The circumstances in which the issue of new rights over areas covered by existing rights lead to tax adjustments will be limited. This limitation will apply in respect of all rights that are acquired or commence to be used from the date of the announcement, ie 9 May 2023.

General insurers to continue use of audited financial information for tax returns

Audited financial reporting information forms the basis of income tax returns for general insurers. The reissue of Australian Accounting Standard AASB 17: Insurance contracts, operative from 1 January 2023, resulted in a misalignment between taxation law and accounting standards and increased compliance costs for general insurers. The government will amend the taxation legislation to realign the taxation law with the reissued accounting standard, effective for income years beginning on or after 1 January 2023.

No announcements about tax residency rules

The Board of Taxation had previously issued reports recommending Australia’s tax residency rules be changed for individuals and for companies. This was agreed to by the former Government but not legislated. Sadly, the current Government has still not announced whether it will proceed with the recommendations.

Tax administration

Lowering the tax-related administrative burden for small and medium businesses

The government will provide $21.8 million over 4 years from 2023–24 (and $1.4 million per year ongoing) to the ATO to lower the tax related administrative burden for small and medium businesses.

Funding includes:

- $12.8 million over 3 years from 2023–24 to trial an expansion of the ATO independent review process to businesses with aggregated turnover between $10 million and $50 million subject to an ATO audit. The trial will commence on 1 July 2024 and run for 18 months

- $9.0 million over 4 years from 2023–24 (and $1.4 million per year ongoing) for 5 new tax clinics from 1 January 2025 to improve access to tax advice and assistance for 2.3 million businesses. Eligibility for funding will be extended to TAFE institutions to improve access to tax clinic services in regional areas.

The measure also delivers reforms to cut paperwork and reduce the time small businesses spend doing taxes:

- from 1 July 2024, small businesses will be permitted to authorise their tax agent to lodge multiple Single Touch Payroll forms on their behalf, reducing paperwork for small businesses

- from 1 July 2024, small businesses will benefit from faster, safer and cheaper income tax refunds by reducing the use of cheques

- from 1 July 2025, small businesses will be permitted up to 4 years to amend their income tax returns, reducing the burden of making revisions.

Reduction in GDP adjustment factor for pay as you go and GST instalments

The GDP adjustment factor for pay as you go (PAYG) and GST instalments will be set at 6% for the 2023–24 income year, a reduction from 12% under the statutory formula.

The 6% GDP adjustment rate will apply to small businesses and individuals who are eligible to use the relevant instalment methods (up to $10 million aggregated annual turnover for GST instalments and $50 million annual aggregate turnover for PAYG instalments) in respect of instalments that relate to the 2023–24 income year and fall due after the enabling legislation receives assent.

Additional funding to address growth of businesses’ tax and superannuation liabilities

Funding will be provided over 4 years from 1 July 2023 to enable the ATO to engage more effectively with businesses to address the growth of tax and superannuation liabilities.

The additional funding will facilitate ATO engagement with taxpayers who have high-value debts over $100,000 and aged debts older than 2 years where those taxpayers are either public and multinational groups with an aggregated turnover of greater than $10 million, or privately owned groups or individuals controlling over $5 million of net wealth.

Amnesty for small business lodgments

A lodgment penalty amnesty program is being provided for small businesses with aggregated turnover of less than $10 million to encourage them to re-engage with the tax system. The amnesty will remit failure-to-lodge penalties for outstanding tax statements lodged in the period from 1 June 2023 to 31 December 2023 that were originally due during the period from 1 December 2019 to 29 February 2022.

Extension of personal income tax compliance program

The Personal Income Tax Compliance Program will be extended for 2 years from 1 July 2025 and its scope expanded from 1 July 2023.

This extension will enable the ATO to continue to deliver a combination of proactive, preventative and corrective activities in key areas of non-compliance, and to expand the scope of the program to address emerging areas of risk, such as deductions relating to short-term rental properties to ensure they are genuinely available to rent.

GST and other indirect taxes

Continued crackdown on GST compliance

Nearly $600 million will be allocated, over an additional 4 years, to GST compliance. This is estimated to generate additional GST receipts of $3.8 billion and the same amount again in other taxes over the 5 years from 2022-23. This funding extension will support the development of more sophisticated analytical tools to address emerging risks to GST revenue and aims to ensure businesses accurately account for and remit GST.

Fuel tax credits — heavy vehicle road user charge increase

The Heavy Vehicle Road User Charge rate will be increased from 27.2 cents per litre of diesel fuel, by 6% per year for 3 years, to 32.4 cents. The first year of the increase will be the 2023–24 income year.

Tobacco excise measures to improve health outcomes and align the treatment of stick and non-stick tobacco tax

Tobacco excise and excise-equivalent customs duty will be increased by 5% per year for 3 years from 1 September 2023, in addition to ordinary indexation, to encourage smokers to quit.

The government will also align the tax treatment of tobacco products subject to the per kilogram excise and excise-equivalent customs duty (such as roll-your-own tobacco) with the manufactured per-stick rate, by progressively lowering the “equivalisation weight” from 0.7 to 0.6 grams. These progressive decreases will occur on 1 September each year from 2023, with the new weight coming fully into effect from 1 September 2026. This will raise the per kilogram duty accordingly.

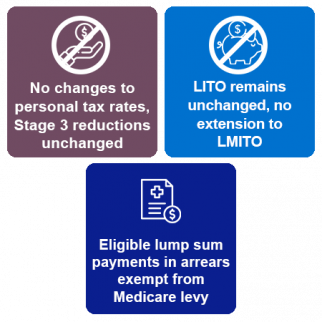

Individuals

Committing to a key election promise, there were no changes to the already legislated ‘Stage 3’ tax cuts to proceed from 1 July 2024.

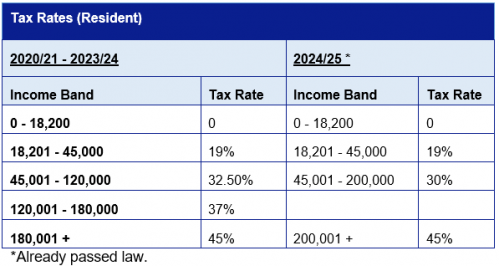

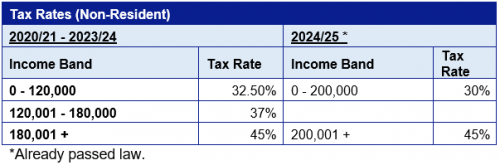

The current and legislated tax rates are as follows:

Note: The Low & Middle Income Tax Offset (LMITO) no longer operates. The Low Income Tax Offset (LITO) of up to $700 continues to apply to resident tax payers with income below $37,500, then reduces up to $66,668. This increases the actual tax-free threshold from $18,200 to $21,884.

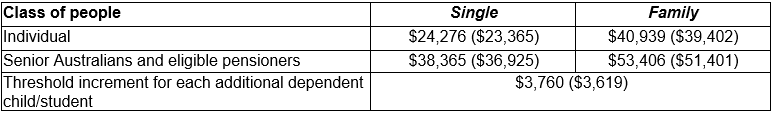

Medicare levy low-income threshold (at or below which no Medicare levy payable)

The new CPI indexed Medicare levy low-income threshold amounts for singles, families, and seniors and pensioners for the 2022–23 year of income are:

Exempting lump sum payments in arrears from the Medicare levy

Eligible lump sum payments in arrears will be exempt from the Medicare levy from 1 July 2024.

This measure will ensure low-income taxpayers do not pay higher amounts of the Medicare levy as a result of receiving an eligible lump sum payment, eg as compensation for underpaid wages.

To qualify, taxpayers must be eligible for a reduction in the Medicare levy in the 2 most recent years to which the lump sum accrues. Taxpayers must also satisfy the eligibility requirements of the existing lump sum payment in arrears tax offset, including that a lump sum accounts for at least 10% of the taxpayer’s income in the year of receipt.

With no significant tax changes for individuals, we highlight some spending measures that may benefit some clients or their families.

Creation of an Energy Bill Relief Fund

Provision of energy bill relief to certain small business customers and social security recipients (pensioners, senior health card holders, family tax benefit A & B recipients). This fund will provide a reduction in energy bills in conjunction with State Governments.

Increased rate for income support payments

Income support payment base rates will be increased by $40 per fortnight.

The increase will apply to JobSeeker Payment, Youth Allowance, Parenting Payment (Partnered), Austudy, ABSTUDY, Disability Support Pension (Youth) and Special Benefit from 20 September 2023.

Expanded eligibility for higher Jobseeker payment rate

The minimum age for which older people qualify for the higher JobSeeker Payment rate will be reduced from 60 to 55 years. This applies to those who have received the payment for 9 or more continuous months.

Eligible recipients will receive an increase in their base rate of payment of $92.10 per fortnight.

Workforce participation incentive measures extended

The workforce participation incentive measures to support pensioners who want to enter the workforce, or work more hours, without impacting their pension payments will be extended for another 6 months to 31 December 2023. Originally announced in the Labor government's 2022–23 Budget, the measure provides age and veterans pensioners a once-off credit of $4,000 to their Work Bonus income bank and temporarily increases the maximum income bank.

Under this measure, pensioners can earn up to $11,800 before their pension is reduced.

Improved support for single parents

Eligibility for Parenting Payment (Single) will be extended to support single principal carers with a youngest child under 14 years of age. The existing eligibility provides support to single principal carers with a child aged under 8 years of age. Improved support for single parents will provide wellbeing benefits particularly for single mothers, who are overwhelmingly the recipients of this payment, and their children. This measure recognises that caring responsibilities can act as a barrier to employment while also recognising that connections with the labour force are likely to improve economic outcomes throughout a carer’s lifetime.

Increased support for Commonwealth rent assistance recipients

The maximum rates of the Commonwealth Rent Assistance (CRA) allowances will be increased by 15% to help address rental affordability challenges for CRA recipients.

Increasing the supply of social and affordable housing and making it easier to buy a home

Expand the eligibility of the Home Guarantee Scheme to:

- allow any 2 eligible people to be joint applicants for a guarantee beyond spouses and de facto partners

- allow non-first home buyers who have not owned a property in Australia for at least 10 years to access the First Home Guarantee and Regional Home Guarantee

- allow a single legal guardian of children to access the Family Home Guarantee

- allow Australian permanent residents to access the Scheme

The Home Guarantee Scheme provides a ‘guarantee’ of up to 15% of the cost of a home allowing buyers to purchase the home with as little as 5% deposit without requiring lenders mortgage insurance.

Superannuation

Despite fears that the 2023-24 Federal Budget would target superannuation to increase tax revenue, there were no unexpected changes with the focus being on the cost of living and establishing a stronger, secure economy.

New wealth tax proposed on individuals with super balance greater than $3m

The Government will be going ahead with its previously announced measure to reduce the tax concessions available to individuals with a total superannuation balance exceeding $3 million, from 1 July 2025.

This reform is intended to ensure that superannuation concessions are better targeted and sustainable. It will bring the headline tax rate to 30 per cent, up from 15 per cent, for earnings corresponding to the proportion of an individual’s total superannuation balance that is greater than $3 million.

The Government has indicated that earnings relating to fund assets below the $3 million threshold will continue to be taxed at 15 per cent or zero per cent if held in a retirement phase pension account.

The Budget papers also note that this measure will include earning amounts calculated on defined benefit fund interests.

While the precise details on how ‘earnings’ will be calculated under this measure are yet to be finalised, and the Budget papers were silent on the methodology to be applied, the initially proposed model broadly relies on a person’s total superannuation balance to calculate earnings. Unless this proposed approach is modified, unrealised gains, accounting adjustments, and/or book entries and tax refunds will potentially be subject to this new tax.

Taxing unrealised gains is a profound change and heralds a significant move to taxing wealth instead of income or realised capital gains. This part of the proposal is not fair or equitable.

Superannuation Guarantee (SG) – changes to payment frequency

From 1 July 2026, employers will be required to pay their employees’ compulsory SG entitlements on the same day that they pay salary and wages. Currently, employers are only required to pay their employees’ SG on a quarterly basis.

This measure will increase the payment frequency of superannuation to align with the payment of salary and wages, ensuring employees have greater visibility over whether their entitlements have been paid and better enable the ATO to recover unpaid superannuation amounts. The increased frequency of payment will also support better long-term retirement outcomes.

This measure was announced prior to the Federal Budget and will provide individuals and their professional advisers greater certainty on the timing of superannuation contributions. From a contribution planning perspective, this is critically important and is expected to help reduce instances of inadvertent contribution cap breaches.

Non-arm’s length income (NALI)

The Government is proposing to amend the NALI provisions that apply to certain expenses incurred by superannuation funds.

Specifically relevant to SMSF trustees, the Government is proposing to limit the level of a fund’s income that is potentially taxable as NALI to twice the level of an impacted ‘general’ expense.

Additionally, fund income taxable as NALI will exclude contributions.

Treasury had previously proposed that the maximum amount of income, subject to the highest marginal rate, would be five times the level of the general expenditure breach. So, on face value, this proposal would appear to result in an improved outcome for SMSF trustees.

However, further details are required to determine whether this calculation relies on the value of the general expense itself or the level of the general expenditure breach – calculated as the difference between the amount that would have been charged for the general expense under an arm’s length arrangement and the amount that was actually charged to the fund.

Other measures

- No extension to the halving of the pension minimum requirements. For the 2024 financial year these will return to the full level.

- The Transfer Balance Cap (TBC) is scheduled to increase from $1.7 million to $1.9 million on 1 July 2023 and despite some speculation, there was no announcement that this will not occur.

- No announcement to allow legacy complying income stream products to be released even though a two-year window was announced in the 2021-22 Federal Budget.

- No further announcements regarding the relaxing of residency rules for SMSFs. This is still apparently on the agenda but no draft legislation has been released.

If you have any questions please speak to your usual Mazars adviser or contact our Tax and Superannuation specialists via the form or contact details below:

Brisbane – +61 7 3218 3900 | Melbourne – +61 3 9252 0800 | Sydney – +61 2 9922 1166 |

Jamie Towers Clive Todd | Evan Beissel Michael Jones | Gaibrielle Cleary Jeremy Mortlock |

Published: 10/05/23

All rights reserved. This publication in whole or in part may not be reproduced, distributed or used in any manner whatsoever without the express prior and written consent of Mazars, except for the use of brief quotations in the press, in social media or in another communication tool, as long as Mazars and the source of the publication are duly mentioned. In all cases, Mazars’ intellectual property rights are protected and the Mazars Group shall not be liable for any use of this publication by third parties, either with or without Mazars’ prior authorisation. Also please note that this publication is intended to provide a general summary and should not be relied upon as a substitute for personal advice. Content is accurate as at the date published.