Overview of mandatory climate reporting in Australia

After several rounds of stakeholder consultations, the Australian Treasury (respectively the Australian Accounting Standards Board - AASB) are soon to finalise the new legislation (respectively the new sustainability standard). With the first reporting period expected to start 1st July 2024 for the largest companies, preparing to disclose climate-related financial information is crucial.

New bill proposes obligatory climate risks

The Treasury released in January an exposure draft legislation Treasury Laws Amendment Bill 2024: Climate-related financial disclosure that seeks to amend parts of the ASIC and Corporations acts.

The new act would introduce mandatory requirements for large businesses and financial institutions to disclose their climate-related risks and opportunities.

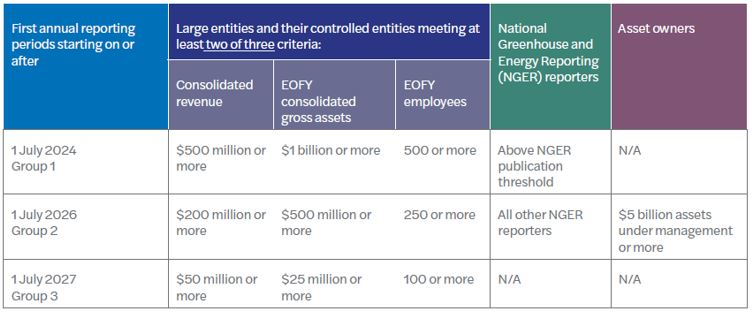

The bill requires entities that lodge financial reports under Chapter 2M of the Corporations Act to meet certain minimum-size thresholds and/or have emissions-reporting obligations under the NGER scheme to make disclosures relating to climate in accordance with AASB sustainability standards.

The amendments would be phased in over four years.

Climate disclosures would be subject to assurance requirements like those in force for financial reports. They would require entities to obtain an assurance report from their financial auditor. The extent and level of assurance would be set out in standards developed by the AUASB.

Proposed sustainability standards builds upon IFRS S1 and S2

The AASB has worked on the development of climate related disclosures during the second half of 2023 and has released ED SRI 1 Australian Sustainability Reporting Standards –Disclosure of Climate-related Financial Information to propose climate-related financial-disclosure requirements.

The exposure draft includes three draft Australian Sustainability Reporting Standards (ASRS):

ASRS 1 General Requirements for Disclosure of Climate-related Financial Information, developed using IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information as the baseline, but with a limitation to climate-related financial disclosure.

ASRS 2 Climate-related Financial Disclosures, developed using IFRS S2 Climate-related Disclosures as the baseline, and ASRS 101 References in Australian Sustainability Reporting Standards, developed as a service standard that would be updated periodically to list relevant versions of any non-legislative documents published in Australia and foreign documents that are referenced in ASRS standards.

Climate-related trends disclosed

The AASB and the AUASB have published updated research in Trends in climate-related disclosures and assurance in the annual reports of ASX-listed entities. It builds on the previously issued Climate-related disclosures and assurance in the annual reports of ASX-listed companies by extending the 2018-2021 sample period to 2022.

The report identifies several trends in climate-related reporting and assurance, including:

- Entities are increasingly disclosing climate-related information in their annual reports and governance statements;

- Climate-sensitive industries continue to be more likely to disclose climate-related information with extant reporting standards and/or guidelines;

- Most disclosures are outside financial statements and therefore not subject to audit; and

- An increase in the number of disclosers referencing Task Force on Climate-Related Financial Disclosures recommendations, including reporting against the ‘four pillars’.

Preparing for climate reporting

Overall, it is important for companies to prepare for climate reporting. Important steps include educating board members and senior management on climate change and related risks and opportunities, performing a gap analysis to develop a list of actions (e.g., GHG emissions calculation; climate scenario analysis), allocating responsibilities for collecting and preparing the required information, and setting up control activities over the climate reporting process.

How we can help

At Mazars we have the expertise and established, trusted professional networks with specialists to deliver services that will enable you to navigate and unlock the potential for your business to benefit from the evolving ESG landscape. If you require assistance, please contact one of our specialists via the form below or on:

| Brisbane – Matthew Beasley | Melbourne – Damien Lambert | Sydney – Jim Mascitelli |

| +61 7 3218 3900 | +61 3 9252 0800 | +61 2 9922 1166 |

Published: 22 March 2024

All rights reserved. This publication in whole or in part may not be reproduced, distributed or used in any manner whatsoever without the express prior and written consent of Mazars, except for the use of brief quotations in the press, in social media or in another communication tool, as long as Mazars and the source of the publication are duly mentioned. In all cases, Mazars’ intellectual property rights are protected and the Mazars Group shall not be liable for any use of this publication by third parties, either with or without Mazars’ prior authorisation. Also please note that this publication is intended to provide a general summary and should not be relied upon as a substitute for personal advice. Content is accurate as at the date published.